AWP Legacy Planning

The audit that

reveals your path to

peace of mind.

Many wealthy families already have done some form of “estate planning”. Our audits often reveal that the people guiding the success of your legacy––the financial planners, the CPAs and the attorneys––aren’t covering all the bases.

Our team has the tools and expertise to identify and correct mistakes that could be putting you at a disadvantage.

Designed to protect

your assets and your

privacy.

As part of our audit process, we create a diagram of all of your entities and assets and point out visually the weaknesses in your existing plan that could make them vulnerable to Creditors, Predators, Divorce and Estate Taxes.

This allows us to articulate the areas we can provide value, while also presenting the information in a way that is clear and digestible.

Often we are able to find a laundry list of areas in a family’s estate plan/corporate structure that can be improved upon from a tax and asset protection standpoint.

Curious about our Estate

Planning services?

Life insurance is

the most neglected

asset class.

Your life insurance contract needs to be managed and reviewed annually. These are not “set it and forget it” assets. Most people are sold contracts by insurance agents who rarely review them – they make their commission and walk away.

Some high net worth individuals will resort to ‘self-insuring’ — without fully grasping the different structures of using life insurance as a cash flow tool.

With AWP’s Life Insurance Analysis, you can take a measured and proactive approach to your LIfe Insurance.

Life Insurance

Strategy & Analysis

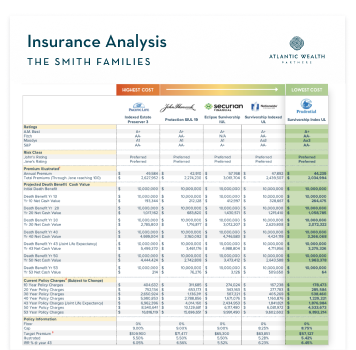

We specialize in advanced life insurance strategies – and have been involved with planning for policies with as high as $100 million death benefits.

After analyzing hundreds of unique situations, we have noticed many of the “well-known” insurance companies end up being the most expensive companies when you look at policy charges over 20, 30, or 40 years.

Just because a policy has the lowest annual premium does not make it the best option. Many factors go into determining the best option, and each scenario is unique.

Let us take a look.

Take a closer look at our partnerships.

Every wealth story is different. See how we

approached some of our actual client partnerships.

Let’s get the conversation flowing.

Fill out our secure intake form and we will reach out to you shortly.